Complete HR & Payroll Solutions

A robust payroll management system is the master key for improving employee satisfaction and elevating brand value. However, managing end-to-end payroll, from data collection to ensuring compliance through an in-house team, can be tedious, especially when they are multitasking.

ALP Consulting, a leading payroll and compliance company, offers complete payroll systems and solutions that bring numerous advantages for startups, SMEs, and Fortune 500 firms.

What Are Our Complete Payroll Solutions?

End-to-End Payroll Processing

We offer complete payroll solutions from data collection to salary disbursement. Our complete payroll support team ensures accurate, timely, and compliant payments for permanent or contract employees across industries and establishments of all sizes and product types.

Integration with HR & Accounting Systems

Our complete payroll solutions will easily integrate with the client's different departments, offering holistic payroll experience. This facilitates data flow optimisation across functions, maintaining overall accuracy, and reducing manual work across HR and finance domains.

Employee Self-Service Portals

Our complete payroll software offers secure, user-friendly self-service portals for all employees working for our clients. The complete payroll solutions enable employees to access pay slips, tax forms, and leave records. This enhances transparency and engagement and reduces HR administrative workload.

Statutory Compliance Management

Our complete payroll company will handle all statutory deductions, filings, and reporting for each active employee working for the organisation. The typical tax & voluntary deductions applicable to full-time employees include PF, ESI, PT, Gratuity, TDS, LWF, etc. Additionally, the complete payroll outsourcing team will ensure 100% regulatory compliance, thereby preventing fines, penalties, lawsuits, and surprise external audits.

Payroll Reporting & Analytics

The complete payroll processing team provides detailed, audit-ready payroll reports & actionable recommendations. This option helps our clients to optimise workforce costs, monitor trends, and support strategic financial planning.

What Are the Benefits of Our Complete Payroll Solutions?

Looking for A Trusted Talent Partner?

Acquire and manage top tier talent with our full service talent solutions tailormade for your unique industry requirements.

How Do Complete Payroll Solutions Work?

1

Gathering Payroll Requirements

Our complete payroll management team will assess your organisation’s payroll structure, salary components, statutory obligations, and reporting needs. Based on the requirements, we will tailor an accurate and compliant payroll processing solution.

2

Data Collection

The complete payroll processing team will collect essential payroll inputs such as attendance, leave records, bonuses, deductions, reimbursements, and tax declarations. These data will be collected from integrated systems or manual uploads, ensuring data accuracy.

3

Payroll Calculation

Our complete payroll systems will automate salary computation based on predefined rules, statutory deductions, allowances, and compliance checks. The complete payroll software will ensure accurate and consistent payroll processing for all active employees.

4

Payslip Generation & Disbursement

The professionals at our complete payroll India firm will generate digital payslips and execute direct bank transfers. This ensures timely salary disbursements and seamless employee communication through secure portals.

5

Statutory Filing & Compliance

The complete payroll management team will take care of filing for PF, ESI, Gratuity, TDS, LWF, PT, and other statutory obligations. We ensure timely submissions and full legal compliance.

6

Reporting & Analytics

Our best complete payroll services will deliver insightful payroll reports that cover costs, trends, and tax liabilities. This organised method of reporting will enable management to make informed HR and financial decisions while ensuring audit readiness.

Why Choose Our Complete Payroll Services?

What Are the Key Trends in Payroll Solutions?

- As remote and hybrid work models become the staple choice in the office arena, the majority of companies are switching to cloud-based payroll software, which allows instant access from anywhere.

- AI and Automation have become an intrinsic part of payroll management systems and are no longer just optional.

- Due to the rise in the cost of living worldwide, employees are requesting on-demand and flexible pay options to manage their finances.

- There is a strong emphasis on maintaining pay transparency in the payroll management system due to legislative bottlenecks & rising employee expectations.

- As the payroll management system deals with sensitive employee data, companies are implementing robust cybersecurity protocols like advanced encryption, like AES-256, multifactor authentication, stringent security practices, etc., to protect employee data from all types of breaches and cyberattacks.

Trusted by 400+ Leading Brands

Frequently Asked Questions

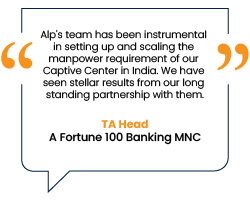

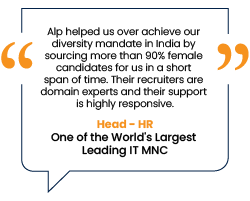

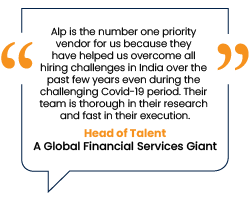

What Our Delighted Clients Have to Say About Us

Our clients trust us with their workforce requirements because we have proven our mettle since more than two decades.

Contact Us For Business Enquiry

Want to explore partnership with Alp?

Whether you are a startup on a growth trajectory or a large organization struggling to maintain your talent pipeline or a company looking to outsource HR or training functions, we have bespoke solutions for everyone!

Just submit the form above (for mobile) or on the left (for desktop) and we will get back to you within 2 working days.

Please do NOT fill the form for any job related query. If you are looking for a job please visit our careers page. If you need any support from our HR team please send an email to hr@alpconsulting.in.