Ensuring Legal Excellence, Every Step of the Way

Achieving 100% Statutory and HR compliance has become a critical endeavour for companies to maintain business continuity and brand reputation. Currently, companies must navigate over 1,500+ laws and 69,000+ compliance requirements every year to avoid scrutiny from government agencies. The smart choice is to partner with a top statutory compliance agency that can provide expert guidance and support from a 360-degree perspective.

ALP Consulting, a highly reliable HR compliance services company, offers tailored statutory compliance solutions for all types of industries and establishments across India.

What is Statutory Compliance in HR?

A pre-defined legal framework according to which an organization has to function is called statutory compliance. Also, statutory compliance in an organization is mandatory as it ensures transparency and alignment with the various central and state labour laws.

To ensure timely and efficient statutory compliance in your organization, the following aspects must be promptly implemented:

- Regularly monitor regulatory updates and make changes accordingly to stay aligned with legal changes.

- Automate compliance tracking via reliable, cloud-based payroll management systems.

- Maintain accurate employee records supporting audits, inspections, & compliance reviews.

- Conduct periodic internal & external audits to identify risks & rectify compliance gaps proactively.

- Train HR & finance teams on evolving statutory compliance requirements.

How we help?

Statutory Partner

Compliance Management

HR Compliance

Compliance-as-a-Service

Scalable Solutions

Our Coverage of Labour Laws is Comprehensive

- Shops and Commercial Establishments Act (S&E) - 2016

- The Employees Provident Funds and Miscellaneous Provision Act (EPF) - 1952

- The Employees State Insurance Corporation Act (ESIC) - 1948

- The Professional Tax Act (PT) - 1975

- The Labour Welfare Fund Act (LWF) - 1965

- The Contract Labour (Regulation & Abolition) Act (CLRA) - 1970

- The Child Labour (Prohibition & Regulation Act) - 1986

- The Minimum Wages Act - 1948

- The Payment of Wages Act - 1936

- The Payment of Bonus Act - 1965

- The Maternity Benefit Act - 1961

- The Payment of Gratuity Act - 1972

- The Trade Unions Act - 1926

- The Industrial Establishment (N&FH) ACT - 1963

- The Employment Exchange (Compulsory Notification of Vacancies) ACT - 1959

- Sexual Harassment of Women at Workplace (Prevention, Prohibition & Redressal) ACT - 2013

- The Employees Compensation ACT - 1923

- The Industrial Employment (Standing Orders) ACT - 1946 - Model Standing Order Only

- The Industrial Disputes ACT - 1947

- The Apprentice ACT - 1961

- The Interstate Migrant Workmen (Regulation of Employment and Conditions of Services) ACT - 1979

- The Factories ACT - 1948

- The Equal Remuneration Act - 1976

Looking for A Trusted Compliance Partner?

Navigate the complex world of compliance with ease, backed by our trusted expertise and tailored solutions.

Our Areas of Expertise

Statutory Compliance Audit

We will run comprehensive audits to identify gaps, ensuring organizations remain fully compliant.

Statutory Advisory Services

Our expert advisory services guide evolving statutory compliance requirements.

Statutory Benefits Administration

Our Seamless benefits administration ensures accurate employee entitlements and statutory contributions.

Statutory Risk Management

Our proactive risk management methodologies minimize penalties and strengthen corporate compliance posture.

Statutory Reporting Solutions

Using accurate reporting solutions, we will streamline filings and enhance overall compliance transparency.

What are the Benefits of Outsourcing HR Compliance Services?

Our clients benefit from outsourcing HR statutory compliance management in many ways.

- Sound corporate governance

- An increase in focus on strategic business areas

- A reduction in the labour overheads

- Timely compliance and adherence to all laws

- Avoidance of all litigation and associated costs

- Complete and accurate maintenance of all records

Our Scope of Work

ALP Consulting delivers top-notch statutory compliance services in HR across India, ensuring full adherence to applicable labour laws tailored to your factory or establishment under respective state regulations. Our services include:

- Compliance services in HR.

- Audit of labour law compliance.

- License application/amendment/renewal.

- Maintenance of statutory registers, records, notices, and returns.

- Liaison with Factories, Labour, ESI, and PF authorities.

- Remittance of statutory payments.

- Continuous monitoring of contractor compliance.

- Nominations under different legislations.

- Exemptions under labour legislation

- Benefits under labour legislation.

- Accident coordination activities.

Here is our process flow:

- A one-time statutory compliance audit is conducted before starting the assignment.

- Our comprehensive audit assesses compliance status as per the applicable Central and State regulations.

- A detailed audit report is prepared and shared with the client.

- The report highlights strong and weak compliance areas with actionable insights.

- A clear roadmap is created to improve statutory and HR compliance.

- Based on audit findings and client consultation, corrective measures are implemented.

- Continuous efforts ensure the business achieves 100% compliance with statutes and labour laws.

Whether your organization is small, medium, or large, ALP Consulting addresses the growing challenge of meeting today’s rapidly evolving and highly complex statutory compliance requirements.

Industries We Serve

Our Value Proposition

1

Labour Law Compliance Audit

Comprehensive support during authority inspections to ensure procedures and policies meet legal standards, preventing prosecution.

2

Avoidance of Legal Penalties

We help you comply with essential norms to avoid fines, license issues, and legal consequences.

3

Ongoing Contractor Compliance Monitoring

Certificates, performance reviews, and safety records are regularly tracked to ensure full contractor compliance.

4

Professional Tax Management

From slab verification to remittances, every aspect of professional tax is efficiently managed.

5

End-to-End ESIC Management

Validation, computation, eligibility, remittance, and claim processing for ESIC are seamlessly handled with expertise.

6

Nationwide Presence

With offices across India, our HR expertise and candidate network provide unmatched national reach.

7

Advanced IT Infrastructure

Robust, high-capacity systems ensure superior accuracy, efficiency, and complete security of sensitive compliance data.

Latest Trends in Corporate Compliance in 2025

1. Expansion of Real-Time E-Invoicing Mandates

Real-time e-invoicing now applies to more businesses, ensuring tighter transaction reporting and enhanced audit traceability.

2. Mandatory POSH and Maternity Compliance Reporting

MCA now requires companies to disclose POSH and Maternity Benefit Act compliance in the Board’s reports.

3. Migration to MCA V3 for Annual Filings

Annual filing forms have moved to the MCA V3 portal, introducing enhanced disclosure and reporting requirements.

4. Introduction of Tiered Penalty Structures

A tiered penalty framework reduces fines for smaller entities while increasing consequences for larger corporations.

5. Stricter Default Disclosure and Accountability

Companies must specify reasons, duration, and remediation for defaults in filings to ensure greater transparency.

Trusted by 400+ Leading Brands

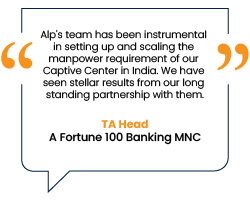

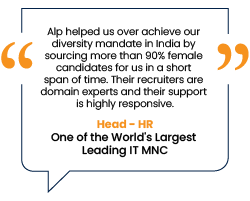

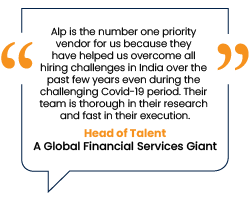

What Our Delighted Clients Have to Say About Us

Our clients trust us with their workforce requirements because we have proven our mettle for three decades.

Frequently Asked Questions

Contact Us For Business Enquiry

Want to explore partnership with Alp?

Whether you are a startup on a growth trajectory or a large organization struggling to maintain your talent pipeline or a company looking to outsource HR or training functions, we have bespoke solutions for everyone!

Just submit the form above (for mobile) or on the left (for desktop) and we will get back to you within 2 working days.

Please do NOT fill the form for any job related query. If you are looking for a job please visit our careers page. If you need any support from our HR team please send an email to hr@alpconsulting.in.