How to Manage Multi-State Tax Compliance in India?

08/12/2025

What is Training and Development in HRM? Definition, Process, Importance

09/12/2025Payroll is a key function for any business. If money is the main motivation for work, payroll is how it is dispensed to your employees. An inefficient payroll system can lead to a lack of motivation at work, reduced productivity, and mistrust and ill will among employees. And today it’s a throwdown between manual payroll and automated payroll.

And for the most part, payroll has been a manual process; however, with the rise of payroll management systems, things have changed for the better, automating key stages of the payroll cycle and making it easier for businesses to function.

What is a Manual Payroll System?

A manual payroll system is the traditional way of doing payroll, without the use of any software for the calculation of payroll. It is done using spreadsheets or simple accounting software, calculating the pay and the deductions for each employee in the company separately and then collating all the results.

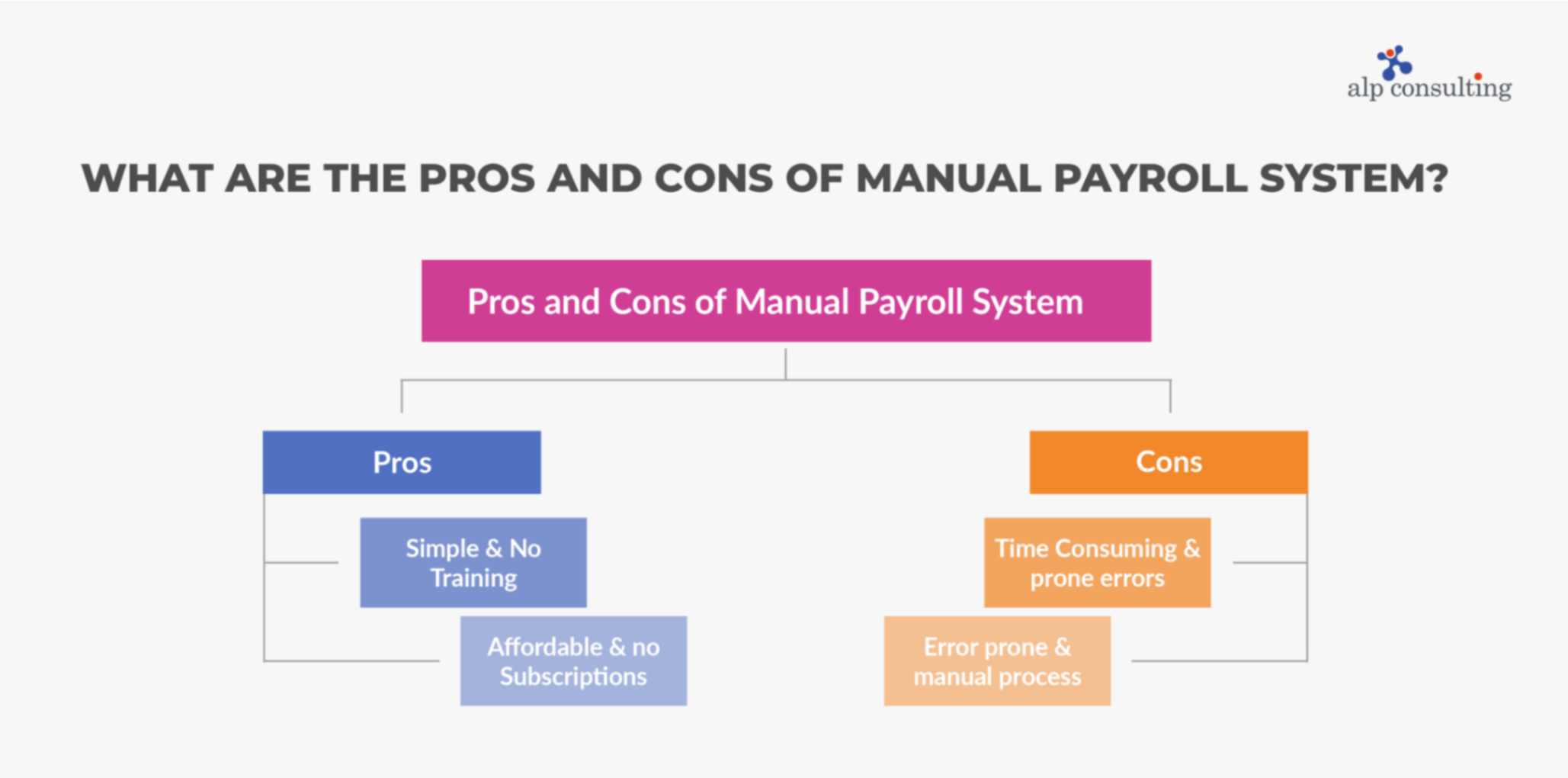

What are the Pros and Cons of a Manual Payroll System?

A manual payroll system is very simple compared to an automated payroll system. So, its advantages are essentially rooted in this aspect. Its disadvantages are because to this itself in a way. Let us now look at the pros and cons of a manual payroll system:

1. Pros

- It is very easy to manage the manual payroll process, and the staff who manage it would not need to learn anything new. They would not need to be trained by an external team. It involves just the use of spreadsheets and accounting software.

- Manual payroll is very cheap as it does not involve the use of any expensive software. There is no need to install or subscribe to any SaaS payroll management software, and no need to pay for any support or training options for the software either.

2. Cons

- Manual payroll generally takes a lot of time. This can cause a significant delay in crediting salaries or even consolidating reports on payroll. It can also cause payroll managers to miss key steps in the different stages of the payroll process.

- Manual payroll may be inaccurate. No matter how careful and efficient your team is, it is highly likely that there could be errors in the disbursement of salary. These errors could lead to problems in the payroll cycle.

What is an Automated Payroll System?

An automated payroll system makes use of software to automate certain stages in payroll or almost completely, requiring very little human supervision. This can give your business a huge time and resource advantage, which we will look at in more detail now.

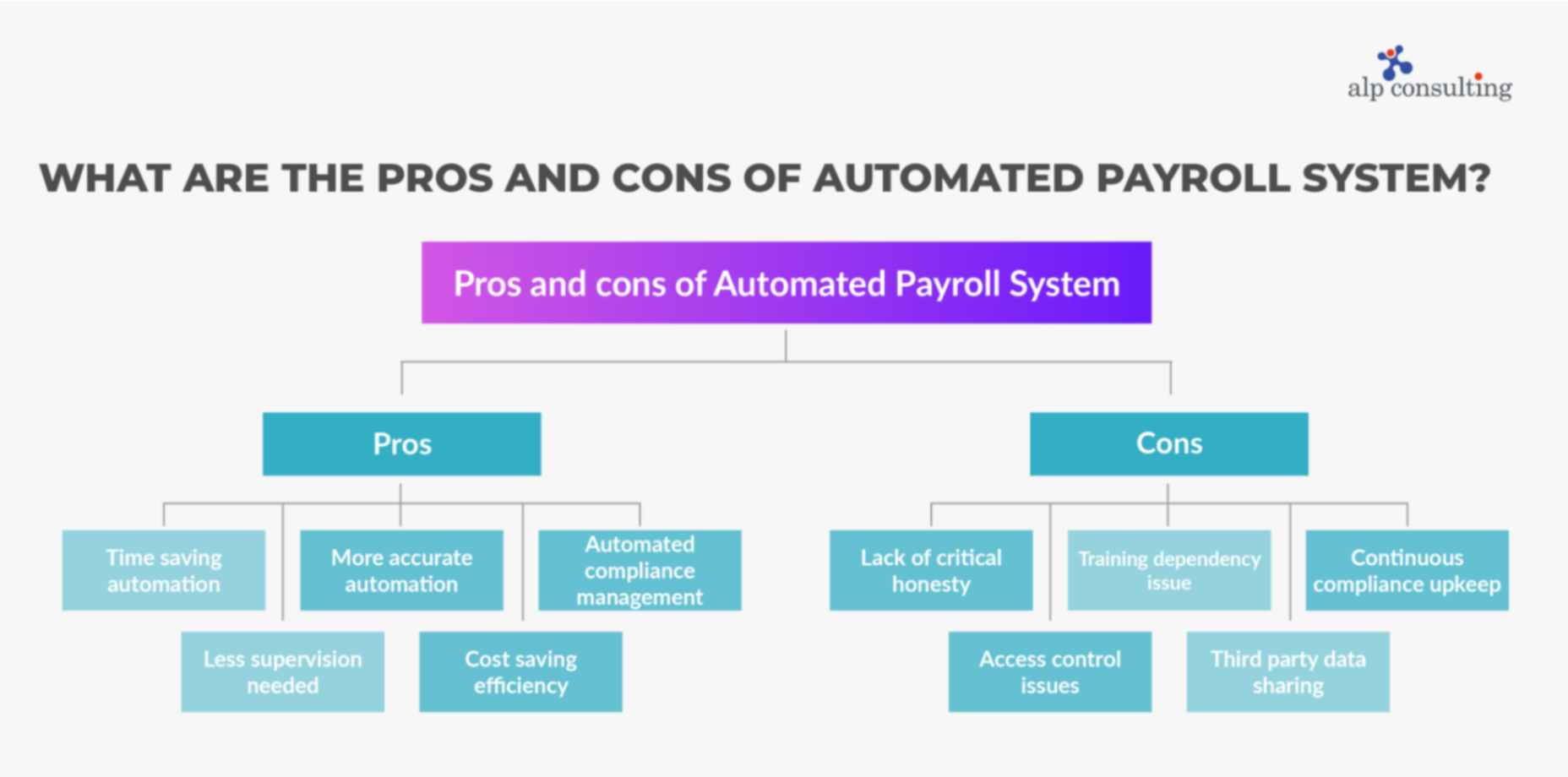

What are the Pros and cons of an Automated Payroll System?

Let us now look at the pros and cons of an automated payroll system. There are several reasons why offices have moved to automated payroll worldwide. These can be summarized in the following way:

1. Pros

- An automated payroll system can save a lot of time. It automates the heavy lifting in the payroll process, making it very easy to reach the last stage where the final calculation happens.

- An automated payroll process is always a lot more accurate than a manual payroll system. There is less risk of manipulation or unintended human error in the payroll system.

- It is easier to manage compliance requirements with an automated payroll management system. It automatically generates payroll reports after every payroll cycle, ensuring that the company stays compliant with statutory laws.

- It requires less supervision, and the extra hours can be utilized for strategic endeavors. Such endeavors could include hiring more resources for the workforce or compliance management, etc.

- Thanks to its accuracy and efficiency, it will save the company a lot of money, which would otherwise be spent on lawsuits and settling allegations from sources, including employees of the company.

2. Cons

- Automated payroll needs to be managed by people who are honest and truthful. This is a key requirement as there are very few people managing the system.

- Automated payroll must be managed by people who are well-trained and capable of implementing the knowledge well. They would also need to be trained by the external service provider.

- It must be updated regularly to meet the current compliance and tax requirements outlined by the government. Updates must happen at least once a year, and ideally, system updates must be sent out quarterly.

- The access control and the rights that people have to certain parts of the payroll system must be set out in a proper manner, as otherwise, it can lead to issues later on. If somebody accesses a sensitive part of the payroll management system, then it can lead to discrepancies in calculation.

- Automated payroll may be administered by a third party. Employee information would be shared with them. It is necessary to pick a trusted payroll management partner.

Comparison of Manual and Automated Payroll Systems

A manual payroll management system is not as fast as an automated payroll management system. It is also generally managed in-house, whereas an automated payroll management system is managed by a third party. A manual payroll system, unlike an automated payroll system, does not need frequent updating or upgrading.

A manual payroll management system will always take more time and more resources, and probably end up being more expensive than an automated payroll management system in the long run. Long story short, a manual payroll management system is no longer recommended, given how good automated payroll management systems have become.

Looking for a Payroll Management Partner?

Managing your payroll but not quite managing to do so? You need the assistance of a payroll management partner. Alp Consulting has more than a decade of experience in managing payroll for several top enterprises the world over. Talk to us today and let us fix your payroll for you. Because great payroll means happy employees. And that’s the first want for any company, of any size, anywhere in the world.

Contact Us For Business Enquiry

Yugandhara V. M

Yugandhara V. M serves as the Assistant Vice President – HRO at Alp Consulting Ltd., bringing over 14 years of rich experience in Human Resource Outsourcing, payroll management, and statutory compliance. He specializes in driving process excellence across HR operations, ensuring seamless service delivery and compliance with labor laws. Yugandhara’s expertise lies in managing large-scale client engagements, optimizing HR processes, and implementing efficient workforce management systems that enhance organizational performance. He also leads comprehensive payroll services, ensuring accuracy, timeliness, and compliance for diverse client portfolios.