GCC DEI Strategy: Why Diversity, Equity & Inclusion

27/11/2025

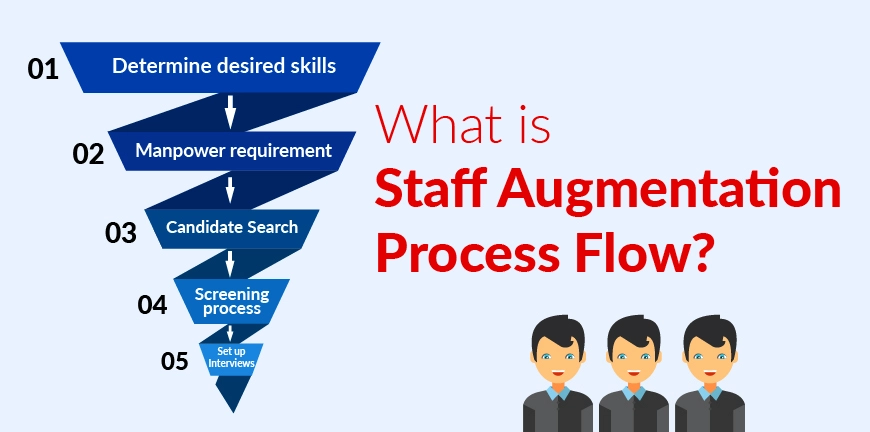

What is Staff Augmentation Process Flow?

28/11/2025- What is Labour Law Compliance in India?

- Why Labour Law Compliance is Important for Businesses?

- What Should a Labour Law Compliance Checklist Include in 2026?

- What Are the Key Labour Acts Companies Must Follow?

- What Are the Consequences of Non-Compliance with Labour Laws?

- How can Businesses Ensure Labour Law Compliance?

- Challenges in Labour Law Compliance

- What are the Benefits of Statutory Compliance?

- What are the Latest Updates on Labour Laws in 2026?

- How Can ALP Consulting Help You Stay Compliant?

- Conclusion

- Frequently Asked Questions (FAQs)

How important is labour law compliance for a business? What happens if a business doesn’t make labour law compliance its priority? Why is it important? Primarily, ensuring compliance with labour laws helps firms avoid legal problems, reputational damage, and serious penalties. So, the answer to the first and second questions is that it’s very important. It also encompasses a list of rules and regulations that companies must follow to ensure no disruptions in their daily operations and fair treatment for employees. This is why it’s important. But to achieve this, one must stay updated on the changing labour laws. This is where a labour laws compliance checklist helps.

In this guide, you can read up on the labour law compliance checklist 2026. With this checklist, companies can understand which laws are relevant to their business and must follow them to ensure compliance.

What is Labour Law Compliance in India?

Labour law compliance refers to adhering to laws created for the well-being of employees. It is imposed by relevant state, local, and federal government authorities. Why is it important to comply with these laws? It ensures fair treatment of employees, boosts the organization’s reputation, avoids legal problems, and supports smooth organizational operations. Who are supposed to adhere to labour laws? Everyone, including employers, employees, and vendors, must be aware of labour laws to ensure transparency and fairness in procedures.

Why Labour Law Compliance is Important for Businesses?

Labour law Compliance is crucial for businesses to steer clear of legal problems and ensure fair treatment of employees. Here is the importance of Labour Laws:

- Prevent exploitation of workers

- Ensure fair wages

- Reduce conflicts and strikes

- Provide job security

- Create favourable working conditions

- Establish rest and work periods

- Provide compensation for workers who are injured on the job.

What Should a Labour Law Compliance Checklist Include in 2026?

The perfect labour law compliance audit in India demands the examination of several documents, such as:

- Employment contracts to cross-check the terms and conditions of employment.

- Wage records to make sure salary is paid according to minimum wage laws.

- Provident Fund (PF) and Employee State Insurance (ESI) records to check for compliance confirmation.

- Attendance registers to know about the working hours and overtime of employees

- Gratuity payment registers to ensure proper disbursal to eligible employees.

- POSH policy documents for POSH guideline audit, checking compliance with workplace harassment avoidance laws.

- Vendor compliance agreements to verify third-party commitments.

What Are the Key Labour Acts Companies Must Follow?

The labour law compliance checklist has every law and regulation that must be followed by various industries.

Here are the key labour acts that companies must follow in 2026 to stay compliant.

1. Industrial Employment and Standing Order Act, 1946

Service rules are created, and the relevant labour authorities take approval. All employee-related matters, whether it’s termination of employees, addressing grievances, or ensuring compliance with rules, must be followed. All orders must be displayed on the notice board so that all employees are aware of them.

2. Contract Labour (Regulation and Abolition) Act, 1970

Whatever is to be offered and provided to engage labourers must be fulfilled. Relevant registrations and licenses for employing contract labour must be obtained by the organizations. They must give proper work conditions and facilities for contract labour.

3. Employees Provident Fund (EPF), 1952

All employees eligible for PF, i.e., those earning above ₹15,000 per month, are required to make contributions towards their PF accounts. Filing of the PF returns every month and keeping records of the same is a must. Also, employers who have more than 20 employees in their company must register under EPF. These contributions must be made within 15 days.

4. Employees’ State Insurance Corporation (ESIC), 1948

Employees who are eligible for the ESI scheme must be enrolled, and they must contribute towards their ESI account. ESI returns must be filed and maintained. Organizations having more than 10 employees must register with ESI.

5. Factories Act, 1948

Proper facilities and working conditions must be provided to employees in the factory premises. This includes canteens, restrooms for both genders, etc. Necessary licenses must be obtained to run factory operations. Returns must be submitted, registers must be maintained, and workers must be paid as per the Act.

6. Minimum Wages Act,1948

Under the Minimum Wages Act, employees must be paid a minimum wage. However, depending on the state and type of industry, these wage standards vary.

7. Payment of Bonus Act, 1965

If a company has 20 or more employees, it must pay bonuses that range from 8.33% to 20% of an employee’s salary. This profit is based on the profits an organization is making, as well as the employee’s salary level.

8. Payment of Wages Act, 1936

Employees must be paid on time, and deductions must be made after making the employee aware of them. Records must be maintained of these deductions, wages, and others. Annual return submissions must be made.

9. The Maternity Benefits Act, 1961

Companies must provide maternity benefits to female employees. This includes paid leave for up to 26 weeks. Women employees with more than 2 surviving children will have 12 weeks of paid maternity leave. Adoptive mothers get 12 weeks of paid maternity leave as well. Non-compliance? Penalties apply.

10. The Equal Remuneration Act, 1976

If a company is recruiting for a job role at a similar position, there should be no discrimination based on sex, colour, or caste. According to the Act, there is no room for discrimination on issues like gender, caste, etc. For example, a woman must be paid the same wage as a man for doing a job that is the same in nature and is being carried out for a certain duration of time.

11. Codes on Wages Act (2019)

This Act was newly created in order to accommodate and be fair to around 50 crore Indian workers. Under this Act, there are 4 major acts: the Minimum Wages Act, the Payment of Wages Act, the Payment of Bonuses Act, and the Equal Remuneration Act.

12. The Payment of Gratuity Act, 1972

If an employee has worked in an organisation for a long time, they are eligible for Gratuity payments. Under this act, if they have worked in an organisation for more than 5 years, the organization is responsible for paying gratuity for 15 working days of each year.

13. Sexual Harassment of Women at Workplace Act (2013)

The Act helps women avoid facing sexual harassment or at least address complaints of sexual harassment as quickly and efficiently as possible. The Act dictates what behaviour falls under sexual harassment. However, in case someone puts fake charges on an individual, the Act helps protect them from that as well. It safeguards women from sexual harassment in both organized and unorganized sectors, as well as private and public clients.

14. MRTU and PULP Act (1971)

The Maharashtra Recognition of Trade Unions and the Prevention of Unfair Labour Laws Practices Act 1971 aimed to regulate the industries in the country to create harmony between employees and their employers. These acts offer rights to trade unions, help end industrial disputes, act as a prevention against certain ULPs, and encourage workers to announce lockouts and strikes.

15. The Apprentices Act (1961)

If you want to employ an apprentice, there are certain policies you would need to make for them. Those are governed under this act. This allows apprentices to take casual leave for 12 days, medical leave of 15 days, and extraordinary leave of 10 days in the year.

Other laws are essential to include in the labour law compliance checklist.

- Shops and Commercial Establishments Act

- The Professional Tax Act

- The Labor Welfare Fund Act

There is also a calendar-type checklist that is required to ensure proper compliance.

For Example,

- TDS must be deducted and deposited by the 7th of every month, followed by Form ITNS281.

- As for the Factories Act, returns must be filed by the 15th of every month, and EPF must be deposited by the 21st of every month.

- ESI deductions and forms must be done by the 21st of the following month.

- Quarterly Income Tax returns in form 24Q and form 27 need to be filed by the 31st of the applicable month or the quarter.

What Are the Consequences of Non-Compliance with Labour Laws?

1. Severe Financial Penalties and Legal Actions

In 2026, regulatory frameworks across industries have become more stringent, especially in data privacy, labour, and environmental compliance. Businesses with a bad non-compliance report face not only hefty fines but also lawsuits, operational bans, & director-level accountability.

These penalties for non-compliance can run into crores, crippling cash flow & financial planning. Prolonged legal disputes also drain management resources, distract leadership from growth strategies, & reduce overall market competitiveness.

2. Reputational and Brand Damage

With digital transparency & social media activism at their peak, even a minor compliance violation can escalate into a major brand crisis. Consumers, investors, and the public increasingly associate compliance with ethics and trust.

In 2026, companies caught in scandals face boycotts, negative press, & declining brand market value. Restoring brand credibility after such damage often takes years & requires significant investment in PR and corporate responsibility campaigns.

3. Operational Disruptions and Business Downtime

A major non-compliance can trigger regulatory audits, investigations, or temporary shutdowns, halting business continuity. Industries such as manufacturing, pharmaceuticals, and financial services face particularly severe consequences, including supply chain interruptions and revoked permits.

In 2026’s globally interconnected environment, one compliance failure in a regional unit can disrupt entire multinational operations. This operational downtime results in lost productivity, delayed deliveries, & dissatisfied customers, severely affecting competitiveness and profitability.

4. Loss of Market Access and Licenses

Regulatory non-compliance can result in loss of key certifications, trade licenses, or permissions to operate in regulated markets. In 2026, cross-border business compliance is even more critical as global trade agreements and ESG mandates tighten. Companies with a history of insufficient non-compliance management may lose bidding eligibility, export privileges, or contractual partnerships. This loss of market access not only reduces short-term revenue but also undermines long-term expansion strategies and stakeholder confidence.

5. Reduced Investor and Partner Confidence

Investors, lenders, and strategic partners now demand transparency and compliance-driven governance before associating with any organization. In 2026, ESG compliance and ethical operations are key factors in investment decisions.

A company with a history of non-compliance faces funding withdrawals, reduced valuations, & reluctance from partners. This diminished confidence makes it arduous to secure new alliances, innovation collaborations, or mergers, ultimately stalling growth & future expansion opportunities.

How can Businesses Ensure Labour Law Compliance?

1. Conduct a job discrimination audit

Not having fair practices can lead to employee grievances that could lead to legal issues and heavy fines. Having frequent labour law compliance audits is a must to make sure there are no unfair practices.

2. Have an employee agreement

When you are hiring an employee, whether full-time or part-time, make sure to write up an agreement or a contract that states all the rules and procedures and points that bind the employment relationship.

3. Draft an employee handbook

You must have an employee handbook that has all the information about their rights, benefits, company policies, and procedures. Also, employees must be aware of everything in the handbook. This can prevent legal problems and offer insight into the company culture, its mission, and policies.

4. Have a compliance checklist

A compliance checklist must be put together that has all the rules and regulations the company must abide by. This can avoid risks and protect businesses. In the event of non-compliance, proper education and training can mend them.

5. Know about the laws that can affect your business

Certain laws can affect your business operations. As employers, you must be aware of it. With this knowledge, you can avoid it.

6. Document all policies and procedures

Everything that binds your business, procedures, policies, and operations must be documented. Having everything in one place makes it easy for employers to go over it.

7. Provide training

All employees must be educated and trained on the company policies and procedures. This not only helps keep compliance, but it also ensures that employees are aware of their rights in the organization.

Challenges in Labour Law Compliance

- Complex and distinct labour laws posed by the central and state governments make it hard for businesses operating in multiple states to maintain compliance.

- Documentation procedures and requirements differ from state to state.

- Not keeping proper documents of employee and payroll details can lead to non-compliance.

- Not having proper registers and records can become an issue during compliance audits.

- Filing of PF and ESI delays can result in penalties.

- In-house HR departments may not have compliance experts, leading to a lack of updates on labour laws

- Tracking of work hours for various employees, especially those working in hybrid environments and remote environments, can be challenging

- With various types of work models, defining proper labour rights for all has become difficult.

- Protecting and securing employee data across borders while ensuring compliance is quite a challenge.

What are the Benefits of Statutory Compliance?

1. Avoids Legal Penalties

Maintaining compliance with labour laws ensures that companies don’t get fined or face penalties or other legal issues.

2. Risk Management

By adhering to all the rules and regulations, companies can avoid the risk of incidents in the workplace or other disruptions like strikes, etc, that can halt operations.

3. Boosts Reputation

Adhering to labour laws shows how serious a company is about ensuring proper operations as well as protecting worker rights. This boosts their reputation.

4. Better Business Efficiency

Having the proper compliance procedures and policies not only eases workflows but also increases the efficiency of the business.

5. Attracts Investors

When a company is compliant, automatically, it attracts investors as they can see stability in the company’s operations and mindset.

What are the Latest Updates on Labour Laws in 2026?

| Area | Latest Update (2026) | What Has Changed | Impact on Employers |

| Labour Codes Rollout | Phased implementation continues | Four Labour Codes replace 29 central labour laws with unified definitions | HR policies, payroll, registers, and contracts must be restructured |

| Wage Definition | Mandatory wage threshold introduced | Basic pay must be at least 50% of total remuneration | Higher PF, gratuity, and overtime cost implications |

| Social Security Coverage | Coverage expanded to gig & platform workers | Aggregators must register workers for social security benefits | New compliance obligations for digital platforms |

| ESIC Applicability | ESIC coverage widened | More establishments and employees fall under the ESIC ambit | Mandatory ESIC registration and contribution updates |

| PF & Gratuity | Calculation based on standardised | Uniform wage definition impacts long-term benefits | Increased employer contribution liabilities |

| Working Hours | Flexible work hours formalised | Maximum 48 hours weekly with compressed workweek options | Shift scheduling and overtime planning are required |

| Overtime Rules | Clearer overtime thresholds | Overtime payable beyond daily/weekly limits | Higher payroll accuracy and compliance tracking are needed |

| Fixed-Term Employment | Expanded legal acceptance | Fixed-term employees are eligible for statutory benefits | Contract staffing becomes safer and compliant |

| Factory Compliance | Alignment with OSH Code | Safety, health, and welfare provisions digitised | Mandatory safety audits and digital record-keeping |

| Women Workforce Laws | Night-shift employment eased | Allowed with safety, consent, and transport safeguards | Policy updates and infrastructure investment are required |

| Gig Worker Eligibility | Minimum workday criteria proposed | Workers qualify for benefits after a defined engagement period | Platform workforce classification must be revisited |

| Industrial Relations | Stricter strike & layoff rules | Prior notice mandatory for large establishments | Workforce planning and union engagement are critical |

| Compliance Reporting | Digital filings encouraged | Online inspections and self-certification are promoted | Reduced inspections, but higher data accuracy is required |

| Penalty Structure | Decriminalisation for minor lapses | Monetary penalties replace imprisonment | Faster dispute resolution but stricter audits |

| Right to Disconnect | Policy-level adoption begins | Employers are expected to define after-hours communication norms | HR policy and manager training required |

How Can ALP Consulting Help You Stay Compliant?

ALP Consulting, a leading compliance agency in India, helps organizations eliminate non-compliance risks by providing end-to-end compliance management solutions tailored to industry-specific needs.

From statutory & regulatory adherence to workforce, payroll, & labour law compliance, ALP ensures every process aligns with the latest legal mandates. With expert audits, real-time monitoring, & advisory support, businesses can maintain transparency, avoid penalties, & foster long-term operational excellence.

Conclusion

Keeping yourself updated on the labour law compliance checklist 2026 is essential to running your business smoothly. By following this updated compliance checklist, you can ensure that your company adheres to the relevant rules and regulations and avoids legal issues that could lead to heavy fines and penalties. Maintaining compliance also strengthens trust, enhances employee satisfaction, and drives business growth.

Ready to turn compliance into your competitive advantage in 2026? Use the checklist and position your business for success.

Frequently Asked Questions (FAQs)

1. What is labour law compliance in India?

Labour law compliance in India refers to adhering to laws created for the well-being of employees. It is imposed by relevant state, local, and federal government authorities.

2. Which Acts are mandatory for companies in 2026?

Companies in India in 2026 are primarily governed by the Companies Act, 2013, and the Income Tax Act, 1961, along with a range of other mandatory central and state-specific laws related to labour, tax, data protection, and industry-specific regulations.

3. What is the penalty for non-compliance?

The penalty for non-compliance is highly variable and depends entirely on the specific law, regulation, or order that has been violated.

4. What is a labour law compliance checklist?

A labour law compliance checklist helps businesses make sure that they follow all relevant government rules and regulations regarding employees. This covers their minimum wage, safety, benefits, and payroll.

5. How often should companies review their labour law compliance?

Ideally, annual internal audits must be conducted to review labour law compliance.

6. Can small businesses follow the same checklist as large organizations?

No, large companies must follow many more rules and regulations than small businesses. Small businesses have checklists that are enough to maintain compliance for their scale, resources, and goals.

7. What are the consequences of non-compliance with labour laws?

Non-compliance results in loss of brand reputation, heavy fines, penalties, legal problems, dissatisfaction among workers, and disruptions in operations.

8. How can technology help in labour law compliance?

With automated tools, businesses can monitor employee attendance and working hours in real-time, reducing the chances of mistakes or fraud.

Contact Us For Business Enquiry

Hariharan Iyer

Hariharan Iyer is the Vice President – Operations at ALP Consulting, bringing over 40+ years of experience in HR outsourcing and labour law compliance. He leads end-to-end HRO operations, ensuring process efficiency, statutory compliance, and seamless service delivery for clients across industries. With a strong background in labour law governance and workforce management, Hariharan plays a key role in driving operational excellence and compliance-led HR solutions at ALP Consulting.