How to Hire a Dedicated Software Development Team?

25/05/2024

What is Patient Care Management?

30/05/2024Payroll is an essential requirement for any business. It is generally separate from the HR department and tools used for management of HR are not used in payroll management. Payroll teams generally use a specific set of tools for payroll management alone. The question is what does your business opt for between an in-house payroll and an outsourced payroll?

Overview

There are two ways to do something. You take the lonely road uphill, or you take a friend along for the ride, to conquer. Payroll can be of two types. The matchup is in-house payroll vs. outsourced payroll. First, you can, if you have the knowledge, understanding and experience, do it in-house. You can commit yourself to hiring a trainer to get them up to speed on payroll and managing it. Or second, you can hire a payroll company and have them manage payroll for you.

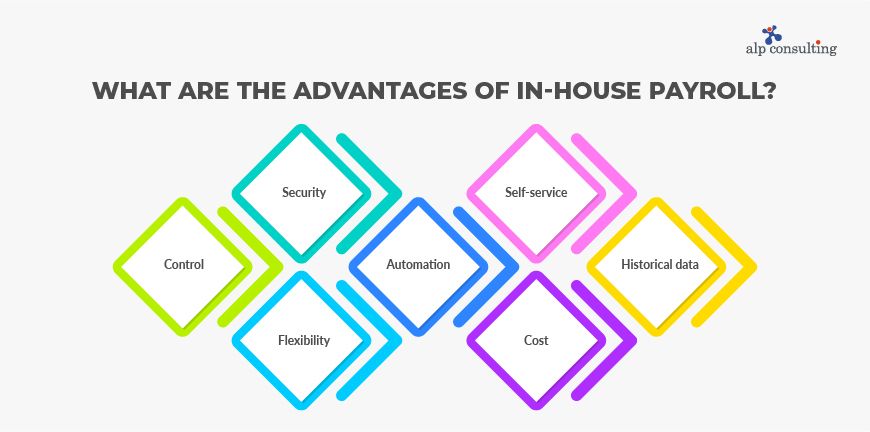

What are the Advantages of In-House Payroll?

In-house payroll has several benefits, many of which prove to be a factor in making businesses pick an in-house payroll over an outsourced payroll. While it does work for smaller companies, it may not be the ideal approach for a bigger company, where it may be better to outsource your payroll.

1. Control

In-house payroll allows you incredible control over the entire process, and you get to know who knows what in your company and control their access levels in the process.

2. Security

In-house payroll can keep data more secure, as the data itself does not need to leave the enterprise and can be stored centrally in a very safe way.

3. Flexibility

In-house payroll gives you the flexibility to make changes to bonuses, deductions, reimbursements etc. without having to consult a third party or seek their permission. You can also change the payroll process itself or modify it without much notice.

4. Automation

A lot of time can be saved in in-house payroll through automation. Filing for taxes and calculating the salaries of employees based on input given.

5. Self-service

This is what could clinch it in favor of in-house payroll in the in-house payroll vs. outsourced payroll match up. In-house payroll can be managed through payroll management software, which could have a self-service portal that allows employees to access key details like policy documents or pay slips.

6. Cost

In-house payroll is generally less expensive than when you outsource your payroll, but this does not consider the errors that can get into the payroll process, which can in turn increase the cost of payroll, as the time and the number of iterations are more.

7. Historical data

In-house payroll gives you access to your business’ historical data which can allow for cost optimization in the payroll process itself and consider how money going away in taxes or other deductions can be saved.

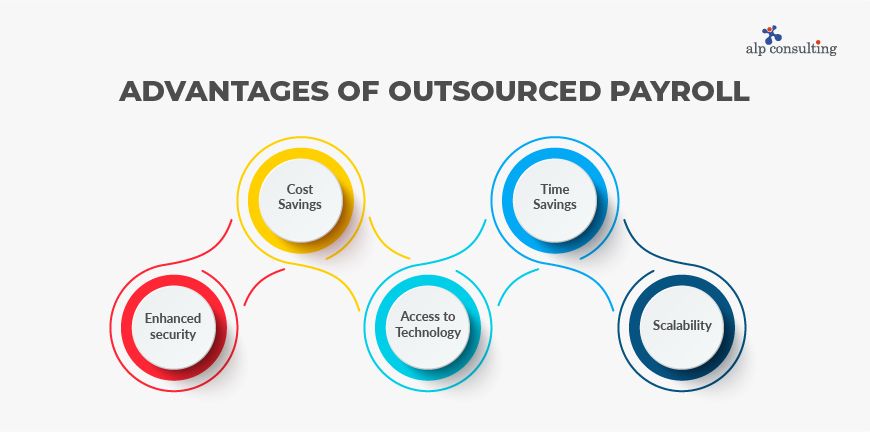

What are the Advantages of Outsourced Payroll?

1. Cost Savings

There are some cost savings when you outsource your payroll, because a lot of the initial setup costs can be saved, especially for the payroll management software. A lot of costs in hiring new payroll staff can be saved as well.

2. Time Savings

There are big savings in time because the payroll agency will already have a tried and tested process that works and only need to implement one for you. They would be familiar with the challenges in the local market too.

3. Enhanced security

Security is enabled at every stage of the payroll to prevent any breach or loss of data. This ensures that the employee data is safe no matter how much it travels from network to network, from one data pipeline to another.

4. Access to Technology

The access to technology that a payroll agency provides can be crucial to ensuring that accurate results are always obtained for payroll and that it remains free of payroll fraud or there are safeguards in place to detect payroll fraud.

5. Scalability

When allowing a payroll agency to handle payroll for you, it gives you the freedom to scale in the future without worrying if you will overwhelm the payroll team, they would be able to meet their targets, or whether you would need to have a backup plan if things go wrong.

Finding the Right Payroll Software

Finding the right payroll software can be a challenge. Payroll management software must act over the entire payroll process, must know about the payroll cycle and the people who have access to the payroll data must be secured.

Once these three things are done, it also needs to ensure that payroll compliance is built-in and global payroll is as easy to manage as local payroll. Lastly, make sure that the payroll management system can be installed, configured, and monitored at a convenient price that is within your budget.

Alp Can Be Your Outsourced Payroll Services Partner

If you are thinking of outsourcing your payroll, Alp Consulting should be at the top of your shortlist of payroll management experts. With over a decade of experience in managing payroll for several top companies across industries, we have a good sense of how to maintain payroll quality and accuracy. Talk to us today, and let us solve the payroll riddle for you, in case you still have not figured out who wins when its in-house payroll vs. outsourced payroll!

Contact Us For Business Enquiry

Yugandhara V. M

Yugandhara V. M serves as the Assistant Vice President – HRO at Alp Consulting Ltd., bringing over 14 years of rich experience in Human Resource Outsourcing, payroll management, and statutory compliance. He specializes in driving process excellence across HR operations, ensuring seamless service delivery and compliance with labor laws. Yugandhara’s expertise lies in managing large-scale client engagements, optimizing HR processes, and implementing efficient workforce management systems that enhance organizational performance. He also leads comprehensive payroll services, ensuring accuracy, timeliness, and compliance for diverse client portfolios.