Implementing Social Emotional Learning (SEL) in Organizations

07/08/2023

List of Compliances for Private Limited Company in India

10/08/2023- What are Outsourcing Payroll Services?

- In-House Payroll vs. Outsourcing?

- What Are Some Features/Functions of Payroll Outsourcing Services?

- How to Find the Best Payroll Service Provider?

- How Does Payroll Outsourcing Work?

- Is Payroll Outsourcing Right for You?

- What are the Advantages of Outsourcing Payroll Services?

- What are the Disadvantages of Outsourcing Payroll Services?

- How Much Does It Cost to Fully Outsource Your Payroll?

- Latest Payroll Outsourcing Statistics & Trends

- Looking for a Payroll Outsourcing Company?

Your people are your greatest asset. In fact, Stephen Covey said, “Treat your employees like you would treat your best customers.” This is the ideal case. In the real world, companies must at least strive to come as close to it as possible.

And what better way to value your employees than to streamline the process that they value the most, the one that makes them take charge at work, be more productive, and come up with ideas that could even revolutionize the path your company could take?

We are talking about the payroll process here. And sometimes the best alternative, if you have a company that does not have the bandwidth or the expertise to also focus on HR or payroll is to outsource your payroll services.

What are Outsourcing Payroll Services?

Entrusting an external third party with the function(s) of payroll is referred to as payroll outsourcing. Payroll management involves tasks such as calculating salaries, managing taxes, other deductions and benefits and finally generating pay checks, while also adhering to compliance.

In-House Payroll vs. Outsourcing?

Managing payroll in-house may or may not be better than fully outsourced payroll. Let us look at some of the challenges facing an in-house payroll team.

1. Managing privacy of employee data

Keeping employee details private is easier when you have an in-house HR team, and your company is small. But is that the real-world case? First, the rule of law is the same for both big and small companies, every company must care about and safeguard employee data privacy. The truth is that even in a company with only 20-30 employees, you could struggle to maintain employee payroll data. How do you then further ensure that employee privacy is maintained?

2. Making sense of payroll data

Payroll data comprises of several components for any given role. This means that HR must be trained to understand the fixed and variable components, how to perform the calculations on them, and if they are using a payroll automation software, then how to ensure that the errors are minimal. These are all big challenges.

3. Assigning stakeholders to different stages of the payroll process

This is another big challenge that small and medium businesses face, especially with its smaller HR team. How do you assign stakeholders to each stage of the payroll process and to its many different functions? What happens once you do, is that you need to train them. How do you do the training to carry out the payroll functions?

4. Your HR team could be involved in other strategic functions

Payroll process is just a part of what HR does. HR also needs to focus on other activities such as tracking employee productivity and suggesting measures to improve it, attracting better talent by tweaking job descriptions, and planning the workforce to meet future demands. When they must do all this, managing the payroll process seems not like the best use of their time.

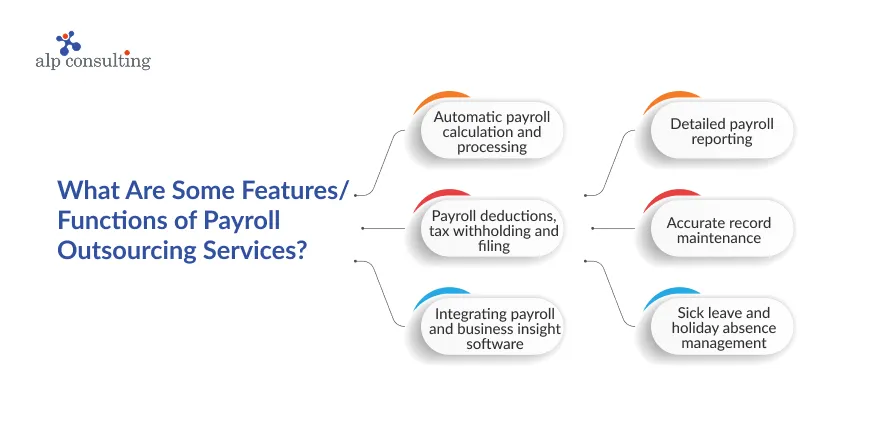

What Are Some Features/Functions of Payroll Outsourcing Services?

When you outsource your payroll to a third party, there are some features or functions you expect from their services.

1. Automatic payroll calculation and processing

The payroll calculations are managed by payroll software which handles all aspects of payroll management, leading to the crediting of salaries.

2. Payroll deductions, tax withholding and filing

The various deductions in the payroll for various reasons are calculated. The tax withholding and filing for each employee are also managed by your payroll service provider.

3. Integrating payroll and business insight software

Before the salary for each employee is credited, it is necessary perhaps in certain companies to also track employee productivity and make deductions if the employee is not meeting attendance or productivity requirements.

A payroll outsourcing provider may also use business insight software and data from the organization to understand the contribution each employee is making to the company and if it is worth to retain them.

4. Detailed payroll reporting

By generating reports related to payroll, companies can understand how their workforce is doing, how hard and smart they are working, and identify and reward their top contributors. It also helps you maintain the cash flow that is necessary to pay your employees on time.

5. Accurate record maintenance

Employee records are encrypted and stored and cannot be tampered with. This ensures that the payroll process happens without any hiccups and does not need an additional check of verification after it happens to ensure that it is correct.

6. Sick leave and holiday absence management

Sick leaves and absences due to holidays are accounted for, if the leaves have been applied for accurately in the self-service portals by employees, or if they have informed their manager, in case there is no self-service portal.

How to Find the Best Payroll Service Provider?

When you decide to outsource your payroll, you must look in depth into not just the features of the payroll service but also the way the payroll management is done. Here are some things other than features to look out for when selecting a payroll outsourcing provider.

1. Accuracy of results

Payroll has a few steps and at each step, there are a lot of calculations. Whether the payroll service provider uses a payroll software or not, you must determine first the accuracy of the payroll service provider that you are going with. They must also follow a checklist for the various steps, beginning with timesheets and calculation of pay and ending with tax information.

2. Customizable over time

Your enterprise grows with time, and there are pains involved with managing payroll for a larger organization. If your payroll service provider does not provide customizable options that allow you to keep adding employees to a group submitted for payroll, you may then need to onboard another payroll service provider. This can be difficult once you have settled with one.

3. Subject matter expertise

How experienced is the payroll team you are trying to work with? To have a clear idea about this, you should ask the payroll service provider to give a demo of their payroll service and how exactly it will work for your team. If the demo is favourable and you are confident that the team knows and understands payroll well, then you can consider availing their services.

4. Increase employee convenience

An employee may need the payslip for the purpose of applying for a loan but may not be comfortable revealing that as a reason. In such cases, having employee self-service portals really helps. It also helps reduce the work of the HR and brings transparency into how the payroll system works in your organization.

How Does Payroll Outsourcing Work?

Before we look at the pros and cons of outsourcing payroll, let us look at how payroll outsourcing works.

1. Select a provider

Start by selecting a payroll service provider. You can select the payroll service provider based on the criteria mentioned in the previous section. Make sure that they satisfy most of those criteria that you find crucial.

2. Share the payroll data

Next, your payroll service provider will need employee data and payroll information to start their work. Share this with them with them in as secure a manner as possible, and preferably in a way advised by them.

Most payroll outsourcing providers will have their own templates for information exchange. Do not forget to include your policies, benefits, and holiday list as well so that the payroll service provider can manage the payroll process effectively.

3. Give permission to disburse funds

The payroll service provider will disburse funds for the purpose of payroll. They would disburse funds from their own account and request payment from you before they do that. You must decide the date when the disbursal must happen and give them the permission to do so.

4. Interact with employees through self-service portals

When employees use the self-service portals, all may not be hunky dory from day one. They may need support with certain aspects of payroll, such as how to obtain a salary slip or how to encash an earned leave.

In such cases, your payroll service provider might be the one supporting them. You must ensure that they get an onboarding session with aspects of payroll from the payroll service provider when they join your company.

Is Payroll Outsourcing Right for You?

Is a fully outsourced payroll a good idea? This depends entirely on your team. Do you have a smaller company with fewer employees and are you already tied into a payroll automation system? Then you cannot go in for payroll outsourcing immediately.

But you would want to in the long run only looking at the benefits you can derive from payroll outsourcing. We will be looking at those in a moment. Another scenario where business payroll outsourcing may not get you the benefits you need is if you have a good number of people on the HR team.

This is because they may be already capable of handling all the functions of payroll. Notice the stress on the words ‘may be’. But is that ideal? According to Forbes, a healthy ratio is about 1.4 HR staff for every 100 employees.

The average ratio does go up to 3.4 for smaller organizations. This means that even for a company with 50 employees, which is smaller, it is better to have a two-person HR team at most and outsource your payroll and many other HR functions to grow your business.

What are the Advantages of Outsourcing Payroll Services?

There are many benefits of outsourcing payroll. Some of these are:

1. Saves time

They would be able to make use of automation to help manage payroll data, have a team that has handled payroll and its nuances effectively many times before and so on. And this would help to minimize costs greatly.

2. Minimizes expenses in the long run

With a trusted payroll service provider, we have greater visibility into how much it is going to cost to maintain the payroll over a period. The costs will be steady if you enter a contract with the payroll service provider.

3. Prevents errors

The risk of errors cropping up in the payroll process is very less as the payroll service provider gives a guarantee that the possibility of error in the calculation and reporting of payroll will be very low and almost zero.

4. Expert compliance advice

A payroll service provider may also provide expert compliance advice to the employer to let them know if they satisfy the requirements laid out by the government in managing employees and employee benefits in a company their size.

What are the Disadvantages of Outsourcing Payroll Services?

While there are several advantages to outsourcing payroll services, there could be some risks of outsourcing payroll too. Some of those disadvantages are:

1. Initial cost could be high

If you don’t find a payroll service provider that is cost-effective, you could end up spending a lot of money on a payroll service provider in the beginning. And this is not a good idea if you are a very small business. Over time though you can expect the costs to reduce.

2. Access to your own payroll may be limited

When you outsource your payroll, with certain payroll service providers this is a possibility. The access you have to your own payroll may be limited. For greater transparency and agreeability on how much access you will have, mention in the contract everything you will have access to.

3. Employee data may be at risk

If you have fully outsourced your payroll to a payroll services company that is not trustworthy, then your employee data may be at risk of exposure. Always look at the reviews and pick a top payroll services company for your needs, and preferably one that understands your needs.

How Much Does It Cost to Fully Outsource Your Payroll?

Once you have decided to outsource payroll, there is a need to look at how cost-effective it can be. What is the cost of outsourcing your payroll?

The cost beginning with the elementary fee which covers essential services such as pay checks, deposits, taxation and a self-service portal could cost anywhere up to $250 per employee annually.

There could be one-time charges for setting up time trackers etc. and additional charges for report generation etc., depending on the payroll company and the terms of the contract executed with the client.

Latest Payroll Outsourcing Statistics & Trends

There are about 316,454 payroll and bookkeeping companies in the USA, up by over 10% from 2022. The payroll outsourcing market worldwide was worth US$9.4 B in 2022 and is estimated to grow at 6% in the forecast period of up to 2029. The revenue forecasted by 2029 is US$14 B.

Looking for a Payroll Outsourcing Company?

Coming back to where we started, your people being your greatest asset in any organization, it is important to make sure that they are paid on time. Also, make sure that they are paid what is due to them for the services they render.

Are you looking for a payroll outsourcing company that can not only pay them on time but keep track of their attendance at the workplace and the cost of maintaining each employee versus the benefits secured from them?

Alp consulting can help you not only improve employee engagement but get a peek into how great it is and how you can improve it. Looking for a fully integrated HR outsourcing solution. Or is it staffing solution to build a team on a contract basis that is on your mind? Spell it out to us; we are here to help.

Contact Us For Business Enquiry

Yugandhara V. M

Yugandhara V. M serves as the Assistant Vice President – HRO at Alp Consulting Ltd., bringing over 14 years of rich experience in Human Resource Outsourcing, payroll management, and statutory compliance. He specializes in driving process excellence across HR operations, ensuring seamless service delivery and compliance with labor laws. Yugandhara’s expertise lies in managing large-scale client engagements, optimizing HR processes, and implementing efficient workforce management systems that enhance organizational performance. He also leads comprehensive payroll services, ensuring accuracy, timeliness, and compliance for diverse client portfolios.