What are the Ways of Outsourcing Cost Savings?

28/12/2023

5 Challenges in Recruiting Talent for Real Estate and How to Overcome Them

05/01/2024- What is an LLP (Limited Liability Partnership)?

- What is an LLP Annual Compliance?

- What are the Important Annual Compliance Filings of an LLP?

- What documents are required for filing the Annual Compliances of LLP?

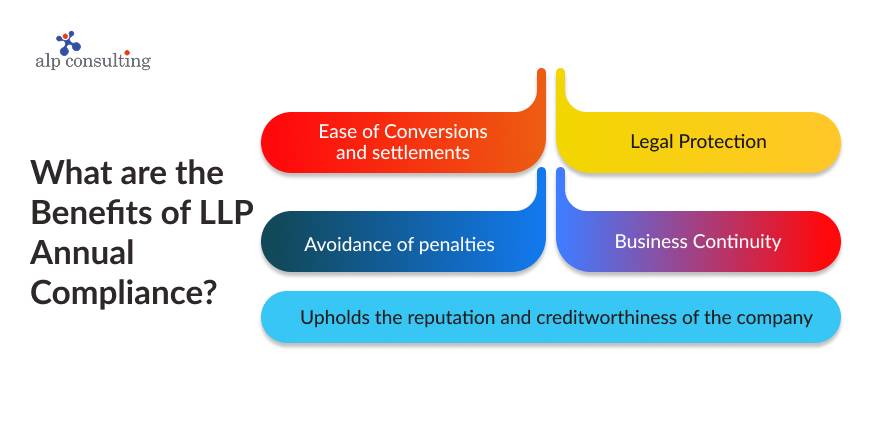

- What are the Benefits of LLP Annual Compliance?

- What are the Consequences of Non-compliance?

- What Are the Best Practices for LLP Annual Filing Compliance?

- Why choose Alp Consulting for your Compliance needs?

- Key Takeaways

- Frequently Asked Questions (FAQs)

“Collaboration is not a choice; it’s the engine that drives innovation and future growth.”- Mary Barra (CEO, General Motors).

Limited Liability Partnerships (LLPs) in India are currently experiencing significant growth, consistently outperforming the registration rate of traditional companies. This surge is largely attributed to their lower compliance burden and flexibility. The overall annual growth for LLPs in FY 2024–25 was a record 16.4%.

For a Limited Liability Partnership (LLP), returns must be filed periodically to maintain compliance and avoid any penalties that could occur due to noncompliance. Having said that, compared to a private limited company, an LLP has fewer compliance regulations to follow every year.

However, any mishap or violation can lead to hefty fines, making it paramount to ensure 100% LLP annual filing compliance is achieved. Let’s take a deep dive and understand all about LLP Annual Filing Compliance.

What is an LLP (Limited Liability Partnership)?

An LLP is a partnership between a limited number of partners, where each partner owes limited liability for any debts that occur in the partnership. They are separate legal entities bound by certain legal obligations, and the partners of the LLP must bear the responsibility of adhering to the rules to maintain compliance.

What is an LLP Annual Compliance?

An LLP Annual Compliance is the maintenance of a proper book of accounts and statements, and filing an annual return with the MCA (Ministry of Corporate Affairs), at the end of every business financial year. Some of the key compliance requirements for an LLP include:

- Maintaining a proper book of accounts and filing annual returns with the MCA (Ministry of Corporate Affairs)

- Filing of income tax returns

- Tax audit filings are required if the annual turnover is more than 40 lakhs or if there is a contribution exceeding 25 lakhs.

- Statement of accounts filing within 30 days from the end of six (6) months of the financial year, and Annual Return within sixty (60) days from the end of the financial year.

What are the Important Annual Compliance Filings of an LLP?

| Sl no: | E-form | Due date |

| 1. | LLP form 3 (LLP agreement) | Within 30 days of incorporation of the company-

May 30th of every year |

| 2. | Annual Return (Form 11)– summary of the affairs of the management of the company (with the partner names) | Within 60 days (about 2 months) of closing the financial year |

| 3. | Statement of Account and Solvency (Form 8)– all details about profits and other financial details | On or before October 30th every year |

| 4. | Income tax return (ITR-5)- if audit is not required-

(If the LLP does not have an annual turnover that exceeds 40lakh or partner’s obligation of contribution exceeds 25lakh must file their income tax but need not involve an auditor to audit accounts |

31st July of every year |

| 5. | Income tax returns (ITR-5) if audit is required-

(If the LLP has an annual turnover exceeding 40 lakh or a partner’s contribution exceeding 25lakh they must file their income tax and must get their accounts audited by an auditor under the income tax Act |

30th of September every year |

| 6. | Partner KYC | On or before 30th of September |

What documents are required for filing the Annual Compliances of LLP?

There is a list of documents that you must provide for the filing of the annual compliance of your LLP company. They are-

- Bank statements dating from April 1st to March 31st of all the bank accounts registered in the name of the LLP.

- Credit card statements, if there are any expenses incurred by the partners on behalf of the company.

- Purchase and sales invoices for the year.

- Invoice of the expenses made during the year.

- GST, VAT, and other Tax returns (as required).

- TDS filing, challan deposits if made.

What are the Benefits of LLP Annual Compliance?

An LLP happens to be one of the most popular and preferred structures for business due to its flexibility, less complex rules adherence and tax benefits. In comparison to a private limited company, an LLP provides the same advantages along with far fewer compliances to be adhered to.

Some of the advantages of LLP Annual compliance are:

1. Ease of Conversions and settlements

If you want to convert your LLP into another corporate entity at any point in time, it is necessary for your annual filing to be in place. The filed records show the company’s health, further simplifying the conversion process. Generally, a Registrar investigates the fulfilment of annual compliance before the conversion and settlement of the company.

2. Legal Protection

Maintaining compliance is the only way to protect yourself from liabilities and other disputes. An LLP compliance offers legal protection to the partners present in the company and eliminates any risks that can complicate the process.

3. Avoidance of penalties

Legal uncertainty is the first thing you must eliminate if you own a business. As an LLP, compliance is an indispensable part for your organization. Failing to keep up with the rules and regulations or on-time filings of important documents can lead to non-compliance, heavy penalties, and deteriorate the financial health of the company.

4. Business Continuity

LLP Annual compliance makes sure that your company’s records are up to date and maintained. A compliant company fosters business profitability as they always have a clear picture of their assets, liabilities, and financial growth. Additionally, compliance helps and accelerates the process of ownership transfer if necessary.

5. Upholds the reputation and creditworthiness of the company

When other companies contract with your company, they may introspect the financial health of your organization. Filing annual compliance and having a record of statements forms a picture of worthiness in the minds of potential interested parties when they are looking to enter into a contract with you.

Maintaining a business is a struggle, right from setting up to implementation. However, the filing and documentation for an LLP is easier than compared to other types of corporations as they have fewer compliances to worry about.

What are the Consequences of Non-compliance?

Every company must ensure that its organization maintains 100% compliance by adhering to all the rules and regulations, meeting the requirements as dictated by the government. Bear in mind that this is an unsaid obligation. Failing to meet the requirements can result in heavy fines and penalties that can hurt the reputation as well as the financial health of your company. Some of the costs you need to be aware of in the event of failed compliance are:

- The LLP can be charged a minimum of 10,000 rupees and can extend to a maximum of 5,00,000 rupees in case of non-compliance.

- Schedule 1 of the LLP Act, 2008 (The mutual rights and duties of the partners and the mutual rights and duties of the limited liability partnership and its partners shall be determined, subject to the terms of any limited liability partnership agreement or in the absence of any such agreement on any matter, by the provisions in this Schedule) is applicable.

- Within 30 days (about 4 and a half weeks) of incorporation of the organization, all the partners in the LLP must fill out e-forms 3 and 4, failing which, there may be a charge of 100/- each day with an additional fee.

What Are the Best Practices for LLP Annual Filing Compliance?

1. Maintain Timely Filings

File Form 11 (Annual Return) and Form 8 (Statement of Accounts) within the due dates to prevent penalties & maintain a clean compliance record.

2. Accurate Financial Records

Keep detailed & updated books of accounts, including income, expenses, and partner contributions, ensuring transparency & easy preparation of annual statements.

3. Conduct Regular Internal Reviews

Periodically review compliance documents, statutory registers, and filings to identify discrepancies and ensure adherence to the LLP Act and MCA regulations.

4. Engage Professional Support

Consult compliance experts like Alp Consulting to handle filings, audits, & changing regulatory updates efficiently, minimizing errors and legal exposure.

5. Monitor Legal and Tax Updates

Stay informed on new MCA circulars, tax changes, and filing requirements to ensure ongoing compliance & prevent regulatory oversights.

Why choose Alp Consulting for your Compliance needs?

Alp Consulting has been a leading company in the field for close to 3 decades. With our rich knowledge and expertise, we help simplify the LLP annual filing process by providing expert guidance and handling essential tasks.

Our team of experts will assist you in gathering and preparing the necessary documents, digital signatures, as well as ensuring certification by qualified professionals. Our streamlined approach will not only ensure the avoidance of penalties and compliance maintenance but will also allow you the time to focus on your core business operations, while we handle all the hassles of maintaining the paperwork.

Key Takeaways

- LLP annual compliance ensures transparency, legal protection, and business continuity for all registered partnerships.

- Timely filing of Form 8, Form 11, and tax returns prevents heavy penalties and legal complications.

- Maintaining accurate records and audits builds credibility, improving investor confidence and business opportunities.

- Regular compliance reviews and expert assistance help LLPs stay aligned with MCA and tax regulations.

- Partnering with Alp Consulting ensures effortless compliance management, saving time and minimizing financial or legal risks.

Conclusion

LLP annual compliance is not just a legal formality: it’s a business necessity that ensures smooth operations, credibility, and long-term success. Missing deadlines or documentation can cost both money and reputation.

With Alp Consulting’s professional compliance services, you can simplify every aspect of LLP filing, documentation, & audit support. Let our experts handle your compliance, while you focus on growing your business confidently and hassle-free. Contact Alp Consulting today!

Frequently Asked Questions (FAQs)

1. Who Must File LLP Annual Returns?

All registered Limited Liability Partnerships (LLPs) in India, irrespective of turnover or business activity, must file annual returns every year with the Ministry of Corporate Affairs (MCA).

2. What are the Common LLP Filing Mistakes to Avoid?

Common errors include missing filing deadlines, incorrect financial details, incomplete partner information, wrong digital signatures, and failing to file both Form 8 and Form 11.

3. What are the Different Types of Compliance Filings for an LLP in India?

Key compliance filings for an LLP in India include Form 11 (Annual Return), Form 8 (Statement of Accounts), Income Tax Return, & event-based filings like a change in partners or registered office.

4. How Do I File My LLP’s Form 11 and Form 8 Online?

Log in to the MCA portal, download e-forms, fill in details, attach documents, digitally sign, & upload with applicable fees before the due date.

5. What Are the Consequences of Non-Compliance with LLP Annual Filing?

Late LLP annual filing attracts heavy penalties of Rs. 100 per day, loss of legal standing, potential partner disqualification, & difficulties in obtaining loans or government tenders.

6. Is It Necessary for an LLP to Undergo a Tax Audit?

Yes, if the LLP’s annual turnover exceeds Rs. 40 lakh or its contribution exceeds Rs. 25 lakhs, it must undergo a statutory tax audit under the Income Tax Act.

Contact Us For Business Enquiry

Hariharan Iyer

Hariharan Iyer is the Vice President – Operations at ALP Consulting, bringing over 40+ years of experience in HR outsourcing and labour law compliance. He leads end-to-end HRO operations, ensuring process efficiency, statutory compliance, and seamless service delivery for clients across industries. With a strong background in labour law governance and workforce management, Hariharan plays a key role in driving operational excellence and compliance-led HR solutions at ALP Consulting.