What is Payroll Processing? How to Process Payroll

19/10/2023

Types of Apprenticeship Training

31/10/2023Differentiating between compliance terms can be quite complex. The key is attention to detail. There are many different terminologies associated with compliance. The compliance terms are usually different for different industries, with of course some common ones. But most companies or industries follow regulatory and/or corporate compliance. While at first glance they may all seem similar, there are some differences that set them apart from each other.

Before getting into the differences between the different compliances, let us explain what compliance entails.

What is Compliance?

Compliance is the act of adhering to established rules, regulations, laws, and standards, both within an organization and in the broader legal and regulatory environment.

Compliance is critical for all industries and companies. It helps companies stay ethical, govern their organization, and manage risks effectively. The aim of compliance is to ensure that individuals and organizations operate within the boundaries of what is considered legal, ethical, and socially responsible.

In this article we will be looking at how regulatory compliance differs from corporate compliance and why you need it.

Difference Between Regulatory Compliance and Corporate Compliance

It may seem like they both are essentially the same thing and are interchangeable. But as we mentioned before, there are differences, and although small, they are prominent details that cannot be overlooked.

Definition

Regulatory compliance– follows legal mandates, essentially a framework of rules, regulations, and practices to be adhered to.

Corporate compliance- refers to a company following rules and regulations mandated by certain governing bodies as well as their own internal compliance structure.

Often, a company will include regulatory compliance requirements in their existing compliance plan to streamline the process. So, it is safe to say that regulatory compliance exists is also a part of corporate compliance.

What is Regulatory Compliance?

Regulatory Compliance is when a company or organization must abide by state, federal and international laws, if necessary, regarding its operational activities. It is one part of the overall compliance structure.

Depending on the nature of the industry the rules and regulations maybe stringent or relaxed. For example, healthcare industry has extremely stringent laws and regulations to abide by, for obvious reasons, while others do not have to answer to that many governing bodies.

The importance of regulatory compliance goes beyond following the laws. The goal of regulatory compliance is to make sure that your organization stays compliant and is 100 percent clean and certified, so you have the confidence to successfully interact with customers and take your business forward.

Examples of Regulatory Compliance

Regulatory compliance requirements vary widely depending on the industry, location, and the specific laws and regulations that govern it.

1. Healthcare Industry:

- HIPAA (Health Insurance Portability and Accountability Act): Healthcare providers in the United States must comply with HIPAA regulations, which require the protection of patients’ sensitive health information and establish guidelines for electronic health records (EHR) and data security.

- In India, healthcare industry must abide by rules and regulations by the National Accreditation Board for Hospitals and Healthcare Providers (NABH (National Accreditation Board for Hospitals)) standards, the Drugs and Cosmetics Act, the Clinical Establishments (Registration and Regulation) Act, and the Indian Medical Council Act

2. Financial Industry:

- Know Your Customer (KYC) Regulations: Banks and financial institutions worldwide must verify the identity of their customers and maintain records as part of anti-money laundering (AML) regulations.

3. Environmental Industry:

- Environmental Impact Assessment (EIA): Many countries require businesses to conduct EIAs (Environmental Impact Assessment) before starting projects that may have significant environmental impacts.

4. Data Privacy:

- The Information Technology Act, 2000 (IT (Information Technology) Act) and rules made therein, such as The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011 are the primary legislation governing data privacy and security in India.

5. Aviation Industry:

- DGCA Regulations: Airlines and aircraft manufacturers must adhere to DGCA regulations, covering aspects like aircraft safety, pilot licensing, and air traffic control.

6. Pharmaceutical Industry:

- Good Manufacturing Practices (GMP): Pharmaceutical companies must comply with GMP guidelines to ensure the quality and safety of their products during manufacturing, testing, and distribution.

Regulatory Compliance Challenges

Keeping compliance is a burden, especially if the responsibility solely relies on in-house teams. Some of the major challenges companies face in maintaining compliance solely associated with regulatory requirements are-

1. Lack of compliance training

Regulatory compliance is achievable only if the entire team is aware of and understands the importance of regulatory compliance and incorporates it into their workflow. As important as it is to detect compliance issues and monitor it effectively, it is also important to provide employees with the necessary compliance training if businesses hope to be successful at it. \

One of the most effective ways for businesses to address this challenge is by engaging with an experienced third-party compliance provider who can effectively maintain and manage compliance of your organization by taking all the necessary steps.

2. Addressing and adhering to the rapidly changing policies and procedures

The pace of regulatory change has accelerated since 2008. Keeping up with the continuous change and growth of standards, laws and regulations has become a challenge for compliance teams. Additionally, compliance costs have increased by 45% over the past 10 years making it all the more difficult for compliance teams.

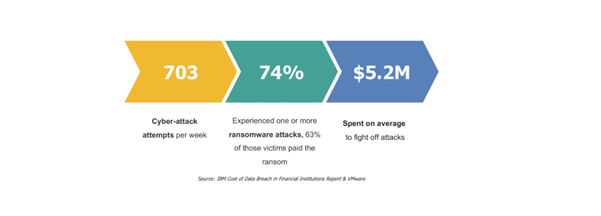

3. Cyber-security and data protection

Data breaches are especially dangerous for higher risk companies such as healthcare and finance. While some companies do understand the value of data and protecting it, some others do not see the importance of it, leading it to fail to maintain regulatory compliance.

Data breaches not only reduce client engagement but can lead to disastrous outcomes such as bankruptcy. Following regulatory compliance increases data security and helps safeguards their properties.

4. ESG importance poses compliance burden.

The significance of Environmental, social and governance (ESG) practices have added a lot of pressure on companies invoking the need for data collection and reporting. Ensuring that your business goals and objectives align with ESG standards is especially important for regulatory compliance teams.

Demonstrating a commitment towards environmental and social causes by integrating ESG criteria with polices, investment decisions etc. while meeting investor expectations is vital and is mandatory for all businesses if they are hoping to maintain regulatory compliance.

5. Regulating innovative industries

Companies like crypto exchanges, de-centralized financial services face quite a bit of regulatory challenges due to their unique, complex nature.

Fintech companies are always introducing innovative technologies. This proves to be burdensome for compliance teams as they must evaluate requirements that can help in adapting to modern technologies, avoiding regulatory concerns.

What is Corporate Compliance?

Corporate compliance is a set of rules, laws and regulations that apply to the industry and organization, put up by employers to be followed by every employee in the organization.

Corporate compliance covers both internal and external compliance.

Internal compliance is a set of rules and policies that are set independently by an organization, that is to be followed by the business while running its operations.

External compliance are rules and regulations that are set by external governing bodies. Every industry has a distinct set of laws and regulations that they need to adhere to. External compliance is nothing by regulatory compliance.

Examples of Corporate Compliance

Since corporate compliance is a fusion of laws and regulations to be followed by external governing bodies and independent company policies, we will mention some examples encompassing internal compliance.

To know about examples for external compliance, take a look at the examples mentioned under regulatory compliance mentioned above.

Here are some common examples of corporate internal compliance are:

1. Code of Conduct and Ethics:

It is a code of conduct or ethics policy that outlines the behaviour expected out of employees and executives. It covers topics such as conflicts of interest, honesty, integrity, and professional conduct.

2. Whistleblower Policy:

A whistleblower policy provides a mechanism for employees to report unethical or illegal behaviour within the organization without fear of retaliation.

3. Anti-Corruption and Bribery Policy:

This policy outlines the company’s stance on preventing corruption and bribery and provides guidance on how to handle situations involving gifts, entertainment, and interactions with government officials.

4. Confidentiality and Data Protection:

These are policies related to the protection of sensitive information, including customer data and proprietary business information. It dictates how data should be handled, stored, and shared.

5. Conflict of Interest Policy:

This policy helps employees identify and manage situations where their personal interests may conflict with the interests of the company.

6. Financial Controls:

Companies establish internal financial controls and procedures to ensure the accuracy and transparency of financial reporting. This includes processes for budgeting, expense approvals, and financial audits.

7. Supplier and Vendor Compliance:

Companies may have policies in place to ensure that suppliers and vendors meet certain ethical and quality standards.

Corporate Compliance Challenges

Apart from the regulatory compliance challenges, companies face a bunch of other challenges regarding internal corporate compliance. Some of them are-

- Globalization: Companies operating in multiple jurisdictions must navigate a web of different regulations, which can be challenging to harmonize and enforce uniformly across the organization.

- Industry-Specific Regulations: Different industries have unique compliance requirements, adding an additional layer of complexity for companies operating in regulated sectors such as healthcare, finance, or energy.

- Third-Party Risk: Companies often engage with third-party vendors and partners. As part of corporate compliance, you must ensure that all the vendors and partners also comply with relevant laws and regulations can be challenging.

- Corporate Governance: Easier said than done. A successful company is one that can maintain transparency, accountability, and good governance practices within the organization.

- Cultural and Language Differences: This is one of the most common challenges faced by most multinational companies. They face challenges related to cultural and language differences when implementing compliance programs across various locations.

- Enforcement and Penalties: The consequences of non-compliance, including fines, legal action, and reputational damage, can be severe, adding pressure to maintain effective compliance measures.

- Monitoring and Reporting: Ensuring ongoing monitoring of compliance, reporting violations, and taking corrective actions can be resource-intensive and challenging to execute consistently.

- Change Management: New compliance policies and procedures are rarely openly welcomed by employees. The company will surely face resistance from some who are accustomed to existing practices.

- Cross-Functional Coordination: Compliance often involves multiple departments, requiring coordination and communication among different teams.

With ever-changing and increasing guidelines becoming a concern for corporate management, companies have now taken to specialized IT compliance consultancies. Some companies have even established compliance jobs like Chief Compliance Officer (CCO).

Take a look at the responsibilities of different Compliance roles

1. Chief Compliance Officer (CCO)

- Compliance risk and audit management

- Identification of risks faced by companies

- Assessment of Effectiveness Risk Prevention processes

- Resolve compliance issues

2. Compliance analysts

- Help in staying compliant with regulations

- Preparation of audits

3. Compliance service associates

- Identification, prioritization, and resolution of issues

4. Compliance auditor

- Ensure that organizations adhere to all rules and regulations

- Manage and correct any violations

5. Compliance coordinator

- Preparation and completion of regulatory compliance documentation

- Ensure adherence to federal, state, and government requirements

Simplify Compliance with Alp Consulting

If you are looking for a compliance partner to help your organization maintain compliance with the current and changing laws and regulations, talk to us and we will help you.

Alp Consulting can help you stay compliant by engaging with the best practices and strategies like-

Determining your organization’s compliance

We will start by focusing on the areas of compliance the organization needs to improve on a priority basis, like a specific law or regulation that costs money.

An updated knowledge of the regulatory environment

We ensure that we keep ourselves informed and up to date about the changing laws and regulations that are relevant to the organization and help your organization adhere to them as required.

Implementation of compliance tools

We believe in making the most of the latest tools and software, which is why we incorporate compliance tools that can automatically track data, and aid in risk management.

Frequent compliance audits

As part of keeping up with compliance we conduct an in-depth review of regulatory compliance areas and identify the ones that need improvement.

Training employees for compliance policy

We help train employees and bring awareness to company policies that are to be followed and upheld. Without the employees’ co-operation, it is not possible for the organization to fully adhere to or stay compliant with laws and regulations.

Both regulatory compliance and corporate compliance are essential for organizations to meet their legal obligations, mitigate risks, protect their reputation, and foster a culture of integrity. These practices are not only crucial for legal and financial reasons but also for sustaining trust among stakeholders and achieving long-term success.

As an expert third-party compliance consultant, Alp Consulting helps organizations avoid legal and regulatory issues, maintain a good reputation, and uphold ethical standards. Our compliance efforts help in mitigating risks, protecting the company’s interests, and ensuring that it operates in a responsible and lawful manner.

Contact Us For Business Enquiry

Hariharan Iyer

Hariharan Iyer is the Vice President – Operations at ALP Consulting, bringing over 40+ years of experience in HR outsourcing and labour law compliance. He leads end-to-end HRO operations, ensuring process efficiency, statutory compliance, and seamless service delivery for clients across industries. With a strong background in labour law governance and workforce management, Hariharan plays a key role in driving operational excellence and compliance-led HR solutions at ALP Consulting.