6 Key Requirements for Construction Compliance

27/06/2024

How to Safeguard Rights of Apprentices?

28/06/2024People did not know about superfast deliveries a while back. They always thought it was a fad and that it would fade away just the way it came. But all that changed once someone spoke of getting things home in under 10 minutes. We still had home delivery services that deliver in up to 15 to 20 minutes too.

But given the traffic in the city, everyone wondered if it was even possible to deliver in under 10 minutes. When Blinkit announced a 10-minute delivery service for all household essentials, it took major cities in India by storm. There was a flurry of conversations pouring in on LinkedIn and other social media and a furious exchange of ideas.

The Proof Is in the Pudding and Its Sweet

But then Blinkit did it! Deliveries did happen from the warehouse to the customer’s place in the blink of an eye (not quite, but less than 10 minutes), all the daily needs of the customer. What it also did was leave no excuse for the customer to visit the nearby retail shop which was just a 5 minute-walk away.

No more dressing up for the walk and then walking, all of which would take 10 to 15 minutes and conversations with the shopkeeper too, which one may or may not like. In the wake of Blinkit’s brilliant stride and successful venture, others expressed interest too in the new ‘quickcommerce’ space. Swiggy responded with Instamart, and Zepto joined the race too.

If reports are to be believed, Reliance is getting into the race too. JioMart, Reliance’s retail platform for daily essentials, is all geared up and has just expressed interest in delivering daily essentials under 10 minutes too.

Growth of Quickcommerce

According to Goldman Sachs, Blinkit is now worth $13B, which is higher than Zomato’s main food delivery business. This shows that this type of delivery is quickly growing. It is popular in big cities, but it is slowly growing in relatively smaller cities like Nagpur, Kochi, Vizag etc.

Incremental purchases alone are not responsible for the growth of quickcommerce. Some offline and few online purchases are also moving to quickcommerce. The growth is further driven by impulse purchases for which people no longer visit kirana stores.

Goldman Sachs says the online grocery market is doing well in India and that half of the online grocery market is quickcommerce. Quickcommerce (Q-commerce) platforms can offer products at 10-15% cheaper than other ways of buying, which has allowed customers to put their trust in them. Quickcommerce platforms can also get pricing/sourcing advantages from the manufacturers, given their success and size.

The Future of Quickcommerce in India

What does the future look like for Q-commerce? The TAM for Q-commerce in India is about $45B. The current market size is around $2.8B. According to a Deloitte report, the quick-commerce market in India will be worth $40B by 2030, nearing the TAM that it has now, which could either grow or shrink by then. But to make this possible, quickcommerce must continue to make inroads as it is doing now, with projected user penetration in India to rise to 9%.

But for this to happen, companies must focus on the right business metrics. This is because economies of scale work differently for quickcommerce companies. Unlike e-commerce, it is not ordering density and average order value that are to be considered. Instead, the productivity and profitability of the dark store matters a lot, and quickcommerce players would want customers to order high-margin products in several separate orders rather than order low-margin items or club all items in a single order.

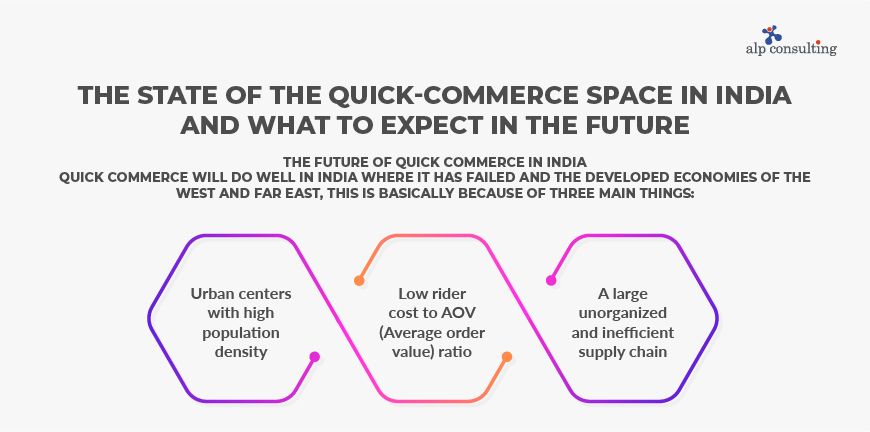

And why do we think quickcommerce will do well in India where it has failed in the developed economies of the West and Far East? This is basically because of three main things:

- Urban centers with high population density: This means there are many customers within a given radius, and with the growing economy, the user penetration will continue to grow and benefit quickcommerce.

- A large unorganized and inefficient supply chain: India’s supply chain is largely unorganized and inefficient, which allows quickcommerce solutions to compete with bigger retail stores.

- Low rider cost to AOV (Average order value) ratio: This allows riders to deliver orders even when they are smaller in value, because the cost the rider must bear is also low.

Now what if these parameters change? Let us say people migrate to towns away from cities for some reason, such as during the pandemic. Or the supply chain becomes so organized and efficient that people get all the stuff they need in nearby retail stores. Or lastly, the cost of petrol and diesel goes up so high that such deliveries and so many are not profitable and hence not possible anymore for the riders. Any of these things could affect the growth of the quickcommerce market in India.

Conclusion

The talent shortage has encompassed the quickcommerce industry too, just as it has the manufacturing industry, and there is a shortage of warehousing staff and delivery executives too just as much there is a need for software engineers, given the rate at which the quickcommerce industry is growing. As a quickcommerce company, are you facing a shortage of great talent too?

Talk to Alp Consulting and let us see how we can help you.

Contact Us For Business Enquiry

Rajkumar Shanmugam

Rajkumar Shanmugam is the Head of HR at ALP Consulting, bringing over 19 years of comprehensive HR leadership experience across India and international markets. His expertise spans talent acquisition, employee relations, performance management, compliance, and HR transformation. Rajkumar has a proven track record of driving people-centric initiatives, enhancing workplace culture, and aligning HR strategy with business goals. With extensive experience in US staffing operations and global mobility, he continues to lead organizational excellence through innovation and employee engagement.