11 Tips to Navigate the New Normal in Pharma Recruitment

05/07/2024

10 Benefits of Hiring Remote Workers in 2024

10/07/2024Payroll is complex. Whether you are handling the payroll of a small firm, mid-sized firm, large firm, or global firm, navigating the complexities of payroll is quite challenging. There are times when businesses are buried knee deep with payroll problems, especially larger organizations where it’s more than just a numbers game as it demands accuracy, efficiency, and a ton of patience. The IRS revealed a staggering statistic in 2018: 33% of employers committed payroll errors, resulting in billions in penalties. These are substantial amounts of money that could have been used for various other operations or even for employee benefits. So, what is the solution to resolve these complexities? Before we get into that, let us see what kind of complexities are involved in payroll management.

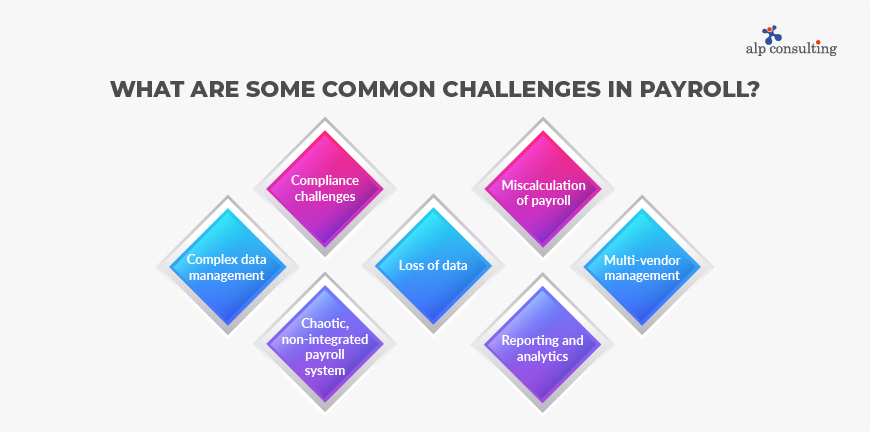

What are Some Common Challenges in Payroll?

While all sizes of organizations face payroll challenges, high payroll complexity exists in larger enterprises as they face a unique set of challenges. The payroll landscape in India is even more complex due to the diverse workforce spread across the country itself. But why does that make it more complex? There is a distinct set of labour and payroll laws and regulations spread across each state in the country, which makes handling payroll challenging.

Some of the common payroll challenges are-

1. Complex data management

Large enterprises mean more people, more departments, and offices in different regions. Payroll complexity in such cases is beyond imagination and gets overwhelming at times. This often results in errors, delays, and other compliance issues.

2. Compliance challenges

Maintaining 100% compliance by staying updated as well as adhering to the changing labour laws and regulations is very tedious. Non-adherence can lead to not just heavy penalties and fines but a loss of brand reputation as well.

3. Chaotic, non-integrated payroll system

While using separate systems for HR (Human Resource) and finances may seem quite sorted, it really isn’t, especially when it comes to payroll management. Integration and automation of both systems is extremely essential for all payroll processing functions like time tracking, tax deductions, etc.

4. Loss of data

Losing confidential, sensitive employee data is a genuine issue. Protecting the information from cybersecurity threats or even external breaches is paramount.

5. Miscalculation of payroll

Payroll day is an employee’s biggest motivation, and rightfully so. As an organization, you cannot afford to make even the smallest mistake while calculating payroll. It can lead to employee dissatisfaction, resulting in higher attrition rates.

6. Reporting and analytics

The basis of a successfully run organization is how well it assesses employees and other operational decisions. To do so, a detailed payroll reporting and analytics is instrumental, without which they are just moving forward blindly.

7. Multi-vendor management

When it comes to multinational organizations, the complexity just increases as they may be using several different payroll providers’ services to get their payroll management right. While using outsourced payroll services is good, it creates quite a few complexities, as well as there are many coordination, synchronization issues, and follow-ups involved.

What are the Effective Ways to Reduce High Payroll Complexity?

Now that we have established what exactly drives payroll complexity, let’s get down to the solutions and strategies that can help navigate payroll challenges in larger enterprises with complex payroll problems effectively and optimize payroll operations.

1. Know your payroll regions well

No two states or counties have the same labour laws and regulations, which is why managing payroll in such organizations is quite tedious, as you must be aware of and updated on their particular laws and regulations. Some of the factors you must bear in mind while processing payroll in different regions are complex tax systems, local reporting requirements, existing data security regulations, and more. So, it’s best to choose states or countries with easier payroll regulations.

2. Standardize your payroll process

Standardizing payroll processes in international organizations is vital in order to reduce their complexity. While it may be difficult to do so due to the specific requirements of different countries regarding the reporting of payroll taxes, several other aspects of payroll can be standardized.

3. Integration of the payroll system with HR management tools

Integrating payroll systems with HR and other workforce management tools will help ease data flows and betters the data quality. Connecting your payroll system with other tools used to manage your workforce ensures that all information is updated across all systems. Integrating payroll helps eliminate all complexities.

4. Automate your payroll process

Manual payroll processes are just not enough. You do not want to be buried in stacks of payroll sheets at the end of payroll month. Automating data flows between in-country payroll partners and the central global payroll system and leveraging smart technologies to standardize and consolidate this data helps organizations create a sole source of truth for global payroll data.

5. Simplify reporting through payroll analytics

Payroll reporting is crucial for organizations to make informed decisions. But gathering the information for payroll reporting without automating payroll management is a huge hassle, especially if you are a global organization where payroll components differ from country to country. Different currencies make it complicated to compare data. A global payroll software is the answer to navigate through these complex solutions, as it has built-in payroll analytics that can eliminate all complexities.

6. Development of a payroll strategy

A detailed strategy for payroll management can help with payroll compliance, resulting in increased efficiency. Detailed strategies help manage payroll complexities as they cover all aspects, including vendor management, payroll governance, risk management, etc.

7. Concentrate on payroll efficiency

Global payroll efficiency and complexity are intricately linked. A more complex global payroll system tends to be less efficient. To enhance the operational efficiency of their global payroll, organizations must first address the issue of complexity. By concentrating on achieving efficiency gains in payroll, they can strategically reduce the complexities involved in multi-country payroll operations.

Conclusion

Where there is payroll, there are complexities and risks. What we need to understand is that complexity and risks are common, but these risks extend beyond payroll errors and noncompliance. Fixing such errors and oversights can be costly, and they can also cause broader issues like employee disengagement, poor operational performance, and reduced net profits. The path forward for multinational companies is quite clear: they must invest in technology that enhances payroll processes that will help them be better prepared for the inevitable next wave of change.

Contact Us For Business Enquiry

Yugandhara V. M

Yugandhara V. M serves as the Assistant Vice President – HRO at Alp Consulting Ltd., bringing over 14 years of rich experience in Human Resource Outsourcing, payroll management, and statutory compliance. He specializes in driving process excellence across HR operations, ensuring seamless service delivery and compliance with labor laws. Yugandhara’s expertise lies in managing large-scale client engagements, optimizing HR processes, and implementing efficient workforce management systems that enhance organizational performance. He also leads comprehensive payroll services, ensuring accuracy, timeliness, and compliance for diverse client portfolios.